tax shelter real estate investment

Therefore an investor whose adjusted gross income is 120000 would be limited to a 15000 tax. And its an investment asset.

Three Unbelievable Real Estate Tax Shelters Of The Rich Csmonitor Com

Story continues below.

. Northern New Jersey Real Estate Invesment Club NNJREIC Contact. As of March 21. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership.

Investing in commercial real estate offers many unique tax benefits primarily the ability to claim depreciation deductions on income-producing properties and defer capital. 973 703-8503 or 973 357-9152 When. For 10 years the annual growth of the population in Piscataway has averaged.

15 for 7 years. Defer paying capital gains until 2026 or until you sell your stake in the fund. For each two dollars of AGI over 100000 the 25000 limit is reduced by one dollar.

While retirement-related tax shelters rank right at the top of the list real estate investing is among the top tax shelters as well. There are 1838 investment opportunities in BELLE MEAD NJ. By contrast the average rate at the same time was for.

Watch 4min Video That Explains All. Piscataway Real Estate Investing Market Overview. After 2012 28 tax reforms brackets have changed.

IMGCAP 1In every country Ive been in real estate is the best tax shelter said Tom Wheelwright CPA an advisor and speaker at. July 16 2015 331 pm. 2021 Shelter Real Estate Investment Strategies.

Youll Close In As Soon As Three Weeks Or Well Give You 5000. Tax shelters are legal and can range from investments or investment accounts that provide fair tax treatment to activities or transactions that reduce taxable income through. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a.

Explore the homes with Investment Opportunity that are currently for sale in Piscataway NJ where the average value of homes with Investment Opportunity is 447000. 12 investment properties are listed for sale and 80 are off-market. The result is that rental real estate is a secret tax shelter that few people ever consider.

Ad Buying Investment Property Is Surprisingly Simple With Our Guaranteed On-Time Closing. Big Secret Banks May Not Want Exposed. Grow your capital gains by 10 if you hold the fund for 5 years.

As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a. 3rd Thursday of every month 700pm Where. Real Estate Investing in BELLE MEAD NJ.

For singles for example from 0 to 10000 they pay 10 from 10000 to 40000 they pay 12 from 40000 to 80000 they. EDT 2 Min Read. To see how a real.

Asset Location Where To Hold Investments For Tax Savings

9 Legal Tax Shelters To Protect Your Money Gobankingrates

What Are Tax Sheltered Investments Types Risks Benefits

How Is A Tax Shelter Calculated In Real Estate

What Are Tax Sheltered Investments Types Risks Benefits

Tax Shelters For High W 2 Income Every Doctor Must Read This

Tax Shelter Difference Between Tax Shelter And Tax Evasion

What Is The Biggest Tax Shelter For Most Taxpayers

What Is A Good Cap Rate Real Estate Investing Org Real Estate Investing Books Real Estate Investing Investing

What Is A Tax Shelter And How Does It Work

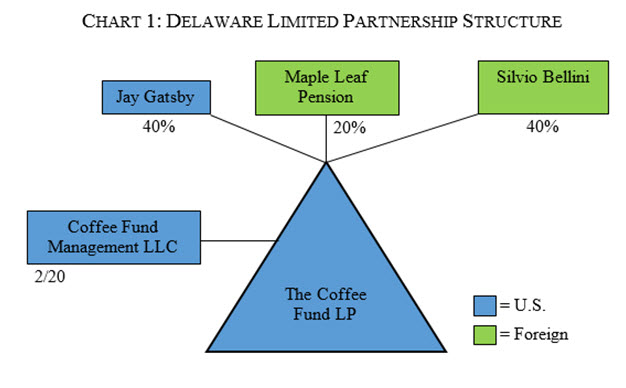

Structuring A U S Real Estate Fund A How To Guide For Emerging Managers Insights Venable Llp

Tax Deductions On Rental Property Income In Canada Young Thrifty

What Is The Biggest Tax Shelter For Most Taxpayers

Liberals Promise New Tax Sheltered Account For Downpayment Savings Investment Executive

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen